At ComplyWith’s annual customer conference, Unplugged ’23, Ian MacKenzie, Head of Legal at New Zealand Green Investment Finance Ltd (NZGIF) shared how NZGIF recently improved its conflicts of interest management process with help from ComplyWith. Here’s a quick recap of Ian’s session.

What does NZGIF do?

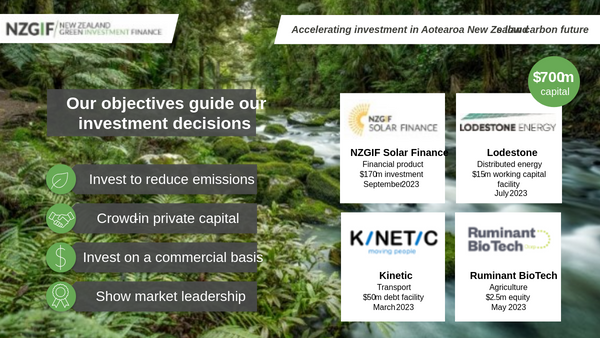

NZGIF is a Crown-owned green investment bank established in 2019 to accelerate investment in emissions reduction in New Zealand.

What was NZGIF hoping to achieve?

As an investor, properly managing conflicts of interest is key to what we do. We simply can’t be seen to be investing in projects that would enrich our own staff.

As a Crown-owned organisation, best practice when it comes to compliance is important to us and we’re committed to leading the way in good practice.

NZGIF needed a simple, system-driven way to achieve good practice in managing our conflicts of interest processes and requirements.

What was getting in the way?

All our team is very busy, so we needed a simple way to promote awareness and understanding and to check compliance. The previous email-based process was not efficient, and people were struggling to regularly update their interests and confirm compliance with our requirements.

Also, with an email-based process, we didn’t have as good an audit trail as we would have liked. We wanted a process that was quick and easy and which would give us good visibility of our compliance with our conflicts of interest requirements.

How did NZGIF arrive at a new approach?

We use the ComplyWith tool for legislative compliance and find that to be really valuable. We outsource the survey set-up, monitoring and reporting back to the ComplyWith team, so we wanted to do something similar with policy compliance, starting with our conflicts of interest requirements.

We set up our conflicts of interest policy in ComplyWith’s Controls Reporting module, in much the same way as legislation is set up in the legal compliance module. We created 3 targeted yet simple questions which were linked to our conflicts of interest policy requirements, our interests register and to external guidance, like the Auditor-General’s guidance on managing conflicts of interest.

How did it go and can you share any insights?

It went really well. We got a great response and people had the ability to update our interests register at the same time, which was particularly efficient. The process for us was really seamless.

Using ComplyWith made the job really simple. We didn’t need to upskill people on new systems, nor did we have to invest in a new tool to do this job. Making compliance easier was really helpful in overcoming any inertia we might otherwise have experienced with our staff.

Any questions for Ian?

What about people who just don’t get the importance of conflicts of interest?

This gives you an auditable trail. Also, horror stories about when conflicts of interest are not well managed may help. “The horror stories are what can get people to sit up and listen.”

Can you do this with other internal policies?

Yes, if you have the Controls Reporting module. We’re planning a programme of reporting on more policies and other requirements using Controls Reporting.

Conclusion

We all appreciated hearing from Ian. ComplyWith found Ian and the team at NZGIF very easy to work with, which makes setting up a new process like this very easy.

If you’d like to find out more about how your organisation could improve its conflicts of interest processes, please contact ComplyWith.